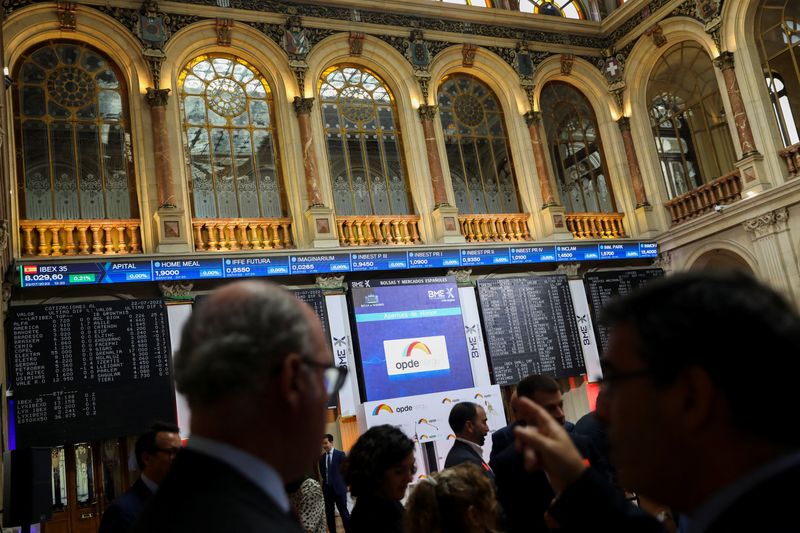

Spain’s IBEX 35-share index started the week with slight gains after the US jobs report raised expectations that the Federal Reserve could cut interest rates further this year.

In a less eventful session due to holidays in Japan and the United Kingdom, markets focused on the Fed’s response to lower-than-expected job creation data released Friday.

The data “raises expectations of a Fed rate cut in 2024 to 2, with the first in September, as Powell cited a significant slowdown in the labor market as one of the reasons for cutting rates,” according to Renta 4 analysts in a report. note for customers.

Markets expect a 45 basis point rate cut this year, with a rate cut in November.

On Monday, investors will look for the release of services PMIs and composite PMIs in Spain, Germany and the eurozone, as well as eurozone producer prices (0900 GMT).

At 702 GMT on Monday, Spain’s IBEX 35 rose 15.80 points, or 0.15 percent, to 10,871.00, while the FTSE Eurofirst 300 index of major European shares rose 0.16%.

In the banking sector, Santander rose by 0.10%, BBVA by 0.12%, Caixabank by 0.76%, Sabadell by 1.19%, Bankinter by 0.35% and Unicaja Banco by 0.24%.

Among major non-financial stocks, Telefónica gained 0.02%, Inditex fell 0.54%, Iberdrola gained 0.22%, Cellnex fell 0.21% and oil company Repsol rose 0.73%.

Indra climbed 5.61% after a 40% rise in net profit in the first quarter, driven by large orders.

(Reporting by Benjamín Mejías Valencia; Editing by Javi West Larrañaga)